Bitcoin Hashprice Hits Rock Bottom: Miners Are Shaken by a Five-Year Low

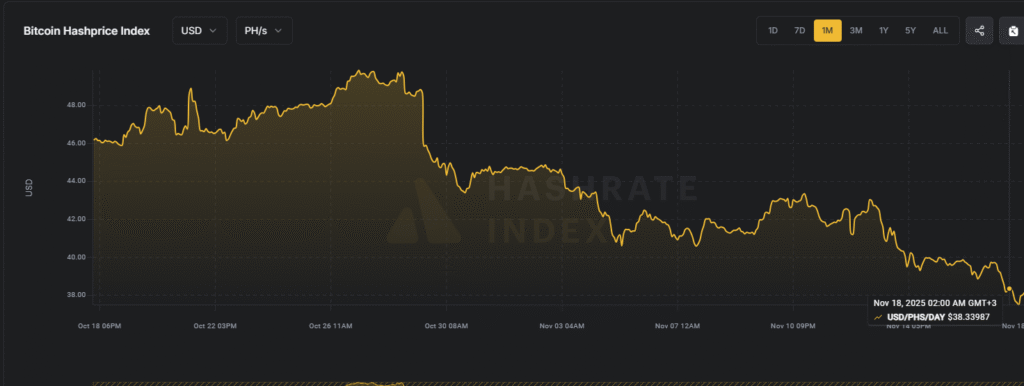

It just got harder to mine Bitcoin. The hashprice, which is an important way to figure out how much money miners make for every unit of computing power, has dropped to $38.2 per petahash per second (PH/s). This is the lowest it’s been in more than five years, since late 2020. Bitcoin’s price is falling below $93,714, which means that this slide comes after gains from earlier in 2025.

Data source:https://data.hashrateindex.com/network-data/bitcoin-hashprice-index

What Exactly is Hashprice?

Hashprice tells you how much money a miner makes every day for each petahash of computing power they give to the Bitcoin network. It takes into account the price of Bitcoin, the fees for transactions, and how hard the network is as a whole.

When the hashprice goes down, miners make less money for the same amount of work. Right now, with difficulty levels near record highs, it’s like running up a hill with extra weight.

Why Is This Happening Now?

Bitcoin’s value has dropped about 30% this year, which means it has lost all of its gains from the past year. Some of the reasons are global market jitters, like how people reacted to Trump’s policies and other political changes.

The network hashrate, which is the total computing power that keeps Bitcoin safe, is still very high, close to all-time highs. This makes things harder, which makes it harder to mine blocks and get rewards.

Public data from places like Luxor and Hashrate Index backs up the drop to about $38-$39 per PH/s.

This is the lowest level since September 2024, but it has been going down for five years now.

The fees for transactions are also low, which adds to the pressure. These fees and block rewards are important to miners, but when there are fewer high-fee transactions, their income goes down.

If costs, like electricity, are higher than earnings, smaller miners might turn off their machines. This could cause “capitulation,” which is when weaker players leave the game. This could make it easier over time.

But bigger companies are changing.

A lot of people are now focusing on AI infrastructure and using their data centers for more than just crypto. For example, HIVE’s revenue grew by 285% in the second quarter of 2025, even though hash prices were low. This was because of AI pivots and a higher hashrate.